Speeding Tickets and Your Insurance: What’s the True Cost?

Will this ticket make my insurance rate increase?

Yes, Your Rate is Likely Going to Increase

When clients ask, “Will this ticket make my insurance rate increase?”, the answer is that it probably will. There are two ways that a speeding ticket can impact your insurance rate. These are through points and the loss of discounts. It’s important to be aware of these possible outcomes when deciding whether to fight a speeding ticket.

Why Hire An Attorney?

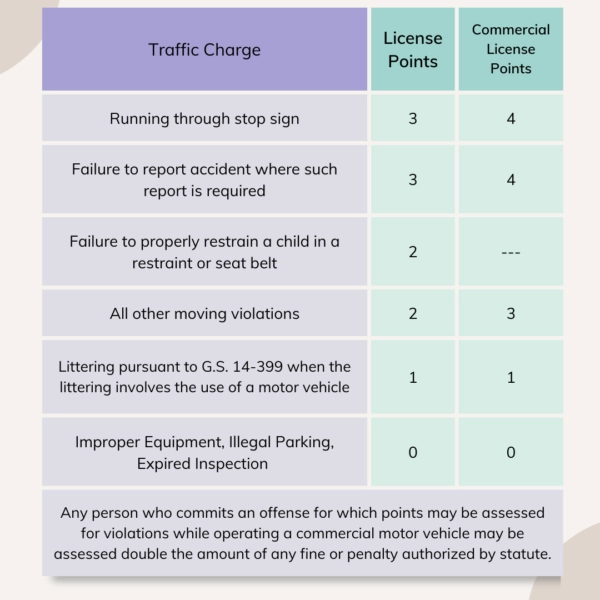

The best thing an attorney can do for you is work out a deal to reduce the charge. If an attorney can reduce the charge then the impact on your license and ultimately your insurance rate will be greatly lessened. In North Carolina, the best reduction for a ticket is called Improper Equipment. By law, an Improper Equipment conviction cannot be used to determine points on your driver’s license or your insurance. However, if an insurance company sees that a driver has multiple convictions of Improper Equipment, the policy provider can decide to remove any safe driver discounts. Hiring an attorney is not a guarantee of a “no points” outcome. Although, without an attorney, you will be pleading guilty to your charge as is and you will get the maximum points on both your insurance and license.

Why Not Just Plead Guilty?

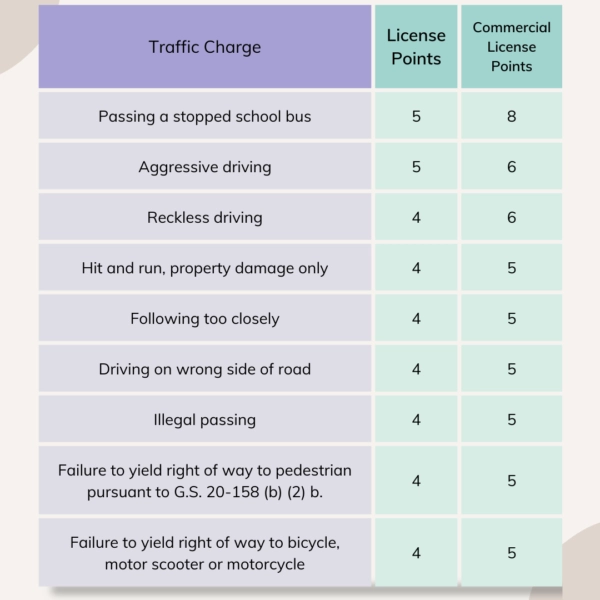

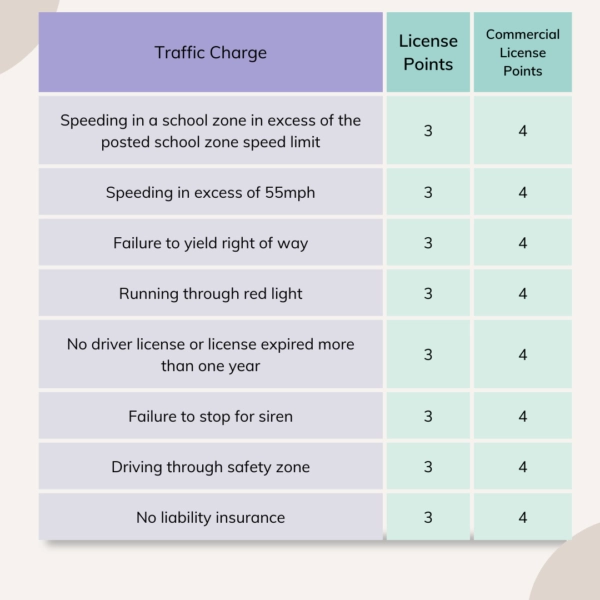

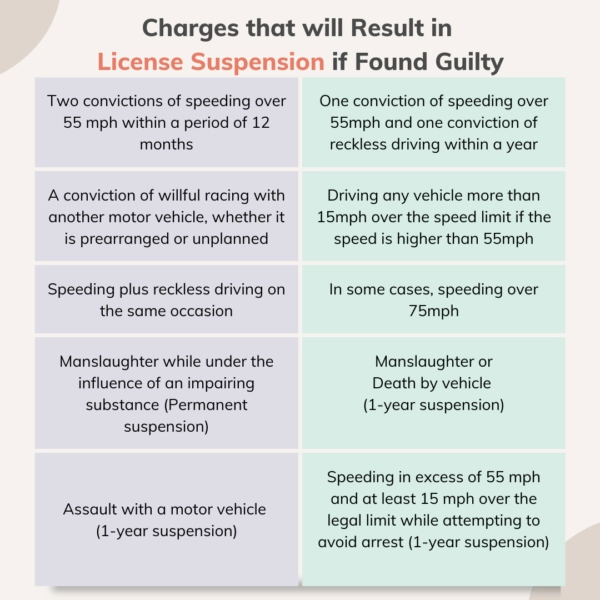

The North Carolina Department of Motor Vehicles (DMV) monitors driver’s license points. Each time a person is convicted of a traffic offense, the DMV adds points to the person’s driving record. The number of points for the specific violation is determined by statute. The license points are added to a driver’s record on the date of conviction, and they stay on a person’s driving record for three years from that date. If a driver gets to twelve points in total, the DMV will typically suspend their license. When you are able to get your license back after your suspension, your license points will be canceled, but your insurance points will not.

Information provided by NC Driver’s Handbook

I Don’t Speed Often. Is Hiring An Attorney Cost-Effective?

Insurance Points

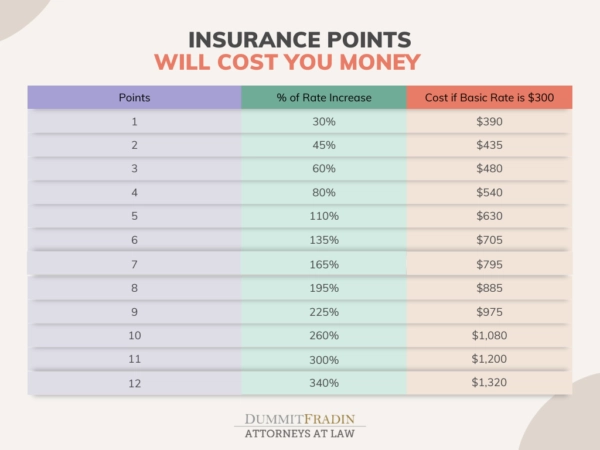

Insurance points are linked to license points, but their effects are unique. Usually, several weeks before a policy renews, an insurance company will order the driving record for each driver listed on the policy. When the policy provider sees that a driver has been convicted of a speeding violation, they will add insurance points to the policy for that driver. However, these points are often calculated differently from license points. For example, most insurance companies have lists that identify certain violations and assign a specific number of points for each violation. Usually, a conviction of “9-over” (the speed limit) is considered a 2-point violation, and a conviction of “14-over” is a 3-point violation. While insurance companies usually have similar lists, one company may charge more (or fewer) points for a specific violation than another company does. The company adds up the total number of points before calculating the final rate. The more points, the higher the rate they charge.

Loss of Discounts

Another way a speeding ticket can affect a person’s insurance rate is through the loss of discounts. Today, most insurance companies give a “safe driving discount.” Usually, a company awards this discount to a person who has a “clean” driving record. This means all of the drivers on the policy are free of accidents, bump-ups, and comprehensive losses in the last three years. If someone gets convicted of a speeding violation, they will almost certainly be given points; and they may also lose the safe driving discount for everyone on the policy as well.

The loss of discounts and the addition of insurance points will cause a significant increase in the cost of insurance over years. The cost of hiring an attorney in the short term may seem expensive, but in the long term, it will save you a lot of money.

Informational chart from NC Department of Insurance

Contact Us

When you get a speeding ticket, it can be a stressful and confusing situation. You may not know what to do or what the consequences could be. It’s important to get help from an experienced traffic attorney. That’s where Dummit Fradin comes in. We have lawyers who know the ins and outs of North Carolina traffic laws and can help you understand your rights and choices. They will also speak on your behalf to try and make a deal to reduce your charge and keep your insurance rates from going up. Contact us to discuss your options.